So you’ve been collecting payments online for years but you know all is not OK. The online payment system you once trusted is now questionable.

Even though you can’t explain, you know something is wrong somewhere because many things are not adding-up.

In this post, we’ll take a look at five signs your online payment system is failing you.

5 Signs You Need to Reconsider Your Online Payment System

1. Fees are adding up

When choosing a payment aggregator, cost is one of the main decision-making factors.

Here are the different costs that come with using a payment aggregator to collect payments online:

Setup fee: This is an initial fee that is charged by a payment aggregator to set up your merchant account. This fee varies. Some payment aggregators do not charge this fee at all. PayUnit for instance does not charge this fee.

Fee per transaction: For each transaction, a payment aggregator has to pay some fees to the Payment Service Provider (PSP).

Examples are fees to the card brand, such as Visa or Mastercard, a fee to the issuing bank, and a fee to the credit card processor. These are a lot of fees for a merchant to understand.

To help merchants, the majority of payment aggregators charge a flat fee for each transaction your customers make.

Here at PayUnit, our fee structure is the most competitive in the Cameroonian market:

- MTN Mobile Money: 2.8%

- Orange Money: 2.8%

- YUP: 2.8%

- Express Union Mobile Money: 2.8%

- Visa/Mastercard: 4.9%

- PayPal: 6.9%.

Maximum Volume: You should also ensure that there are no minimum or maximum volume commitments that might impact rates and fees.

Minimum payout: As a small business with little cash flow, it’s important to find out from your service provider if there is a minimum payout.

N.B: Remember that the lowest rate doesn’t necessarily mean the lowest overall cost. So check carefully before you’d make a final decision.

2. It’s not easy even for developers to setup software

Generally, payment gateway setup is a difficult and time-consuming process requiring you to hire a developer.

What if you don’t have the resources to hire a developer and you probably aren’t a technical person?

After verifying fees, you need to think of the cost of using a payment aggregator with a difficult setup process even for developers.

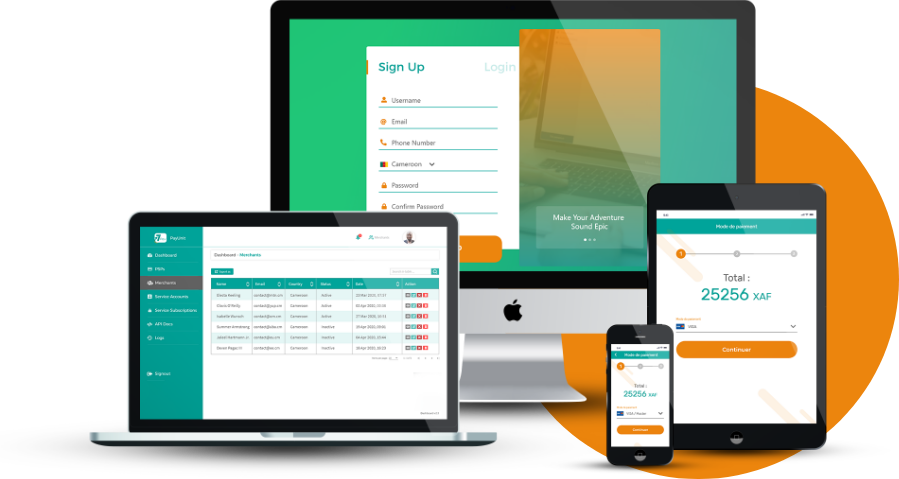

At PayUnit, we have considered this problem.

We have Software Development Kits (SDKs) for every kind of developer:

Our REST API gives more flexibility to creative developers who are not limited to the SDKs listed above.

Verify our full documentation. Also watch our YouTube tutorials.

N.B: Choose a solution that doesn’t require additional software, and that manages the entire payment process securely, and time efficiently.

Indeed, the right payment aggregator can save you many hours of development.

3. Customer support is frustrating

According to Microsoft, globally, 54% of all consumers say that they have higher customer service expectations than they did just one year ago.

When it comes to online payments, customer service is even more important. This is because payment processing is a 24/7 experience.

Your customers need quick response. If you can’t also get quick responses from your payment service aggregator, you’ll lose business.

4. Your payment aggregator doesn’t permit you to accept essential payment methods

You are online because you want to make more sales than you would do otherwise. That’s why you are giving your customers different payment options.

In Cameroon, your payment aggregator should permit you to accept VISA and MasterCard. This is standard for international clients. For your local clients, mobile money is a must.

Moreover, as you do your research, ask yourself: does my business depend on recurring payments?

If that is the case, you need a system that will store customers’ credit card details, and let you automatically charge them on a recurring basis.

Furthermore, you should find out if your payment system has multi-currency support.

This is crucial, especially if you want to run your business globally. Customers mostly want to pay in their domestic currency, and don’t want to spend time on calculating how much they need to pay.

Interfacing with multiple languages is also a great idea. Even if you don’t need to take international payments now, you might need to in the future.

5. Your Customers are complaining about the checkout process

No matter how well designed your eCommerce site is, success ultimately depends on how easily customers can purchase your products.

Ask yourself: is my payment system redirecting users to another site? I’m I collecting only relevant information from the customer? Do the forms look good on my site? Is the payment aggregator secure? What is their PCI compliance level?

A payment aggregator with a PCI compliance level 1 guarantees the highest level in card data protection.

Make your choice!

In order to help you make the right choice, here is a summary of relevant questions to use to interrogate your current online payment system.

- Does your current payment aggregator require a setup fee?

- How much are they charging you per transaction?

- What is the maximum volume of transactions per month?

- What is the minimum payout?

- Do they have software development kits that will save your developers time?

- Are there available documentations and tutorials?

- Does it take days or weeks to resolve a problem with support?

- Are you giving your customers the standard means of payment through your aggregator?

- Are you able to receive recurring payments?

- Does your payment system offer multi-currency support?

- What is their PCI compliance level?

Related Articles

Start collecting payments from your customers online today

No Setup fees.

Most competitive rates in the market.