The Internet is now over four decades old. In Cameroon, it is much younger. How come digital payments are already a big deal?

You remember when it was comfortable browsing the internet at 25Kbps. Back then, streaming was out of the equation. Websites were not important. Cash was all we considered.

Fast-forward to 2021. There are over 7.8 million Cameroonians connected to the internet. Today, not accepting payments online is synonymous to losing business.

According to Mordor Intelligence, the Digital Payments Market worldwide is expected to grow at a CAGR of 13.7% over the forecast period 2021 to 2026.

In this post, let’s discuss 4 reasons why digital payments in Cameroon will skyrocket in the near future.

4 Reasons Why Digital Payments in Cameroon is on the Rise

Table of Contents

1. Convenience

Convenience is the backbone of e-commerce and a huge reason that online shopping has boomed over the last few years. Shopping online offers the convenience of purchasing items when and where it suits you, via a payment method of your choice while also having your item delivered via a method that suits you.

It’s no wonder then that convenience is changing the way people shop and how they view certain shopping options, as the National Retail Federation’s latest research shows. This is why e-commerce brands need to consider more than the quality and price of the products they are offering when it comes to showcasing their proposition.

2. Smartphone Penetration

The number of mobile connections in Cameroon increased by 3.7 million (+19%) between January 2019 and January 2020.

According to Datareportal, Social media penetration in Cameroon stood at 14% in January 2020.

This is thanks to the rapid rise in smartphone penetration. Thanks to this, we’re seeing a rapid increase in mobile wallets as well. All these factors are rapidly propelling the adoption of digital payment services.

3. Government Initiatives

Across the world, increasing government initiatives are promoting the digital economy with the goal of curbing the usage of cash.

For instance, in July 2019, the Finance Ministry of India announced that no merchant discount rate (MDR) shall be imposed on merchants that allow their customers to make payments through ‘low-cost digital payment modes.’

Moreover, the Indian government welcomed WhatsApp Payment, now live for 20 million users. And it’s not only the Indians.

According to the Financial Times:

Chinese policymakers are by far the most advanced in their thinking about a digital currency – the digital renminbi.

The Financial Times

It’s no doubt why digital payment solutions like WeChat Pay are better than anywhere in the world.

As many governments accept and provide the enabling grounds for the growth of digital payments, so too will African governments or the Cameroon government follow.

4. Nature

The COVID-19 pandemic took us unaware. Little did we know that social distancing and lockdowns will become what we will have to live with now and sometime again in the future.

As you know, the solution has been digitalization.

According to eMarketer data, e-commerce sales in 2020 are expected to grow 32.4% YoY, while brick-and-mortar is expected to decline 3.2%.

Note that In 2019, e-commerce grew 14.6% YoY and brick-and-mortar grew a modest 1.5%.

This shift to e-commerce will continue post-pandemic, and brick-and-mortar numbers will rise once again.

How do you start collecting digital payments in Cameroon?

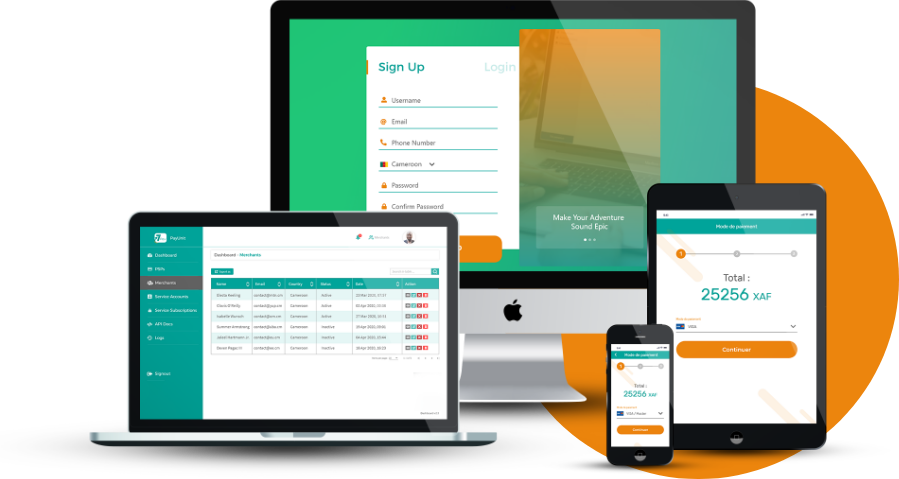

With PayUnit, you can collect and manage payments online from MTN Mobile Money, Orange Money, YUP, Express Union Mobile Money, PayPal, Visa and Mastercard.

It’s a simple process. Sign up for a free account.

Start collecting payments from your customers online today

No Setup fees.

Most competitive rates in the market.